Federal Funding to Measure Wellhead Methane Emissions

In the US oil and gas industry, regulations regarding air pollution have evolved since the Clean Air Act of 1970. These regulations were focused on gas emissions in general, but they did not address methane specifically. It was not until the EPA issued its New Source Performance Standards in 2012 that methane emissions specifically were regulated. Even then, those regulations did not require that methane emissions be monitored from wellheads. It wasn’t until 2021 that emphasis was placed on detecting, measuring, and reducing methane emissions from individual wellheads, thanks to three main federal programs described below.

1 – IIJA grant money for orphan-well plugging

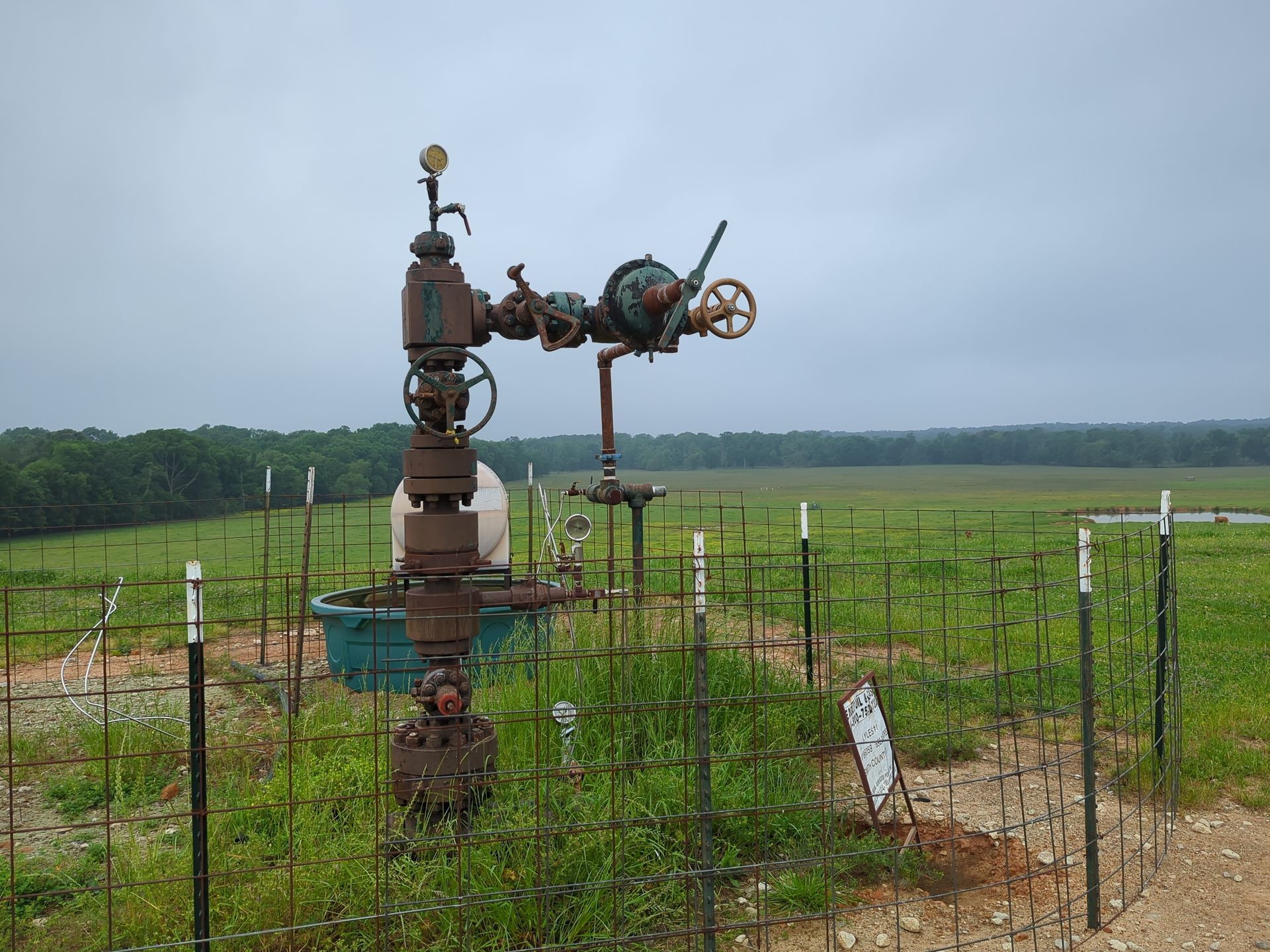

In November 2021 the Biden administration passed the Bipartisan Infrastructure Deal, also known as the Infrastructure Investment and Jobs Act (IIJA). Among many other things, this bill delegated $4.7 billion dollars to plug orphan wells and restore the former well sites (read more here). An orphan well is a well whose former owners went out of business, leaving the responsibility to plug it to the state regulatory agency. In the US, estimates indicate that there are between hundreds of thousands and millions of orphan wells. In addition to being environmental eyesores, they can also leak natural gas into the atmosphere and contribute to climate problems.

Phase one of the IIJA funding included $25 million to 22 states with orphan wells. This money came with spending requirements, but was designated 1) to begin prioritizing orphan wells to plug, 2) to establish plans to measure methane emissions, and 3) to conduct well plugging and site restoration activities. Now, states are in the process of receiving phase 1 formula grant money for 2024, following the July 2023 Department of Interior (DOI) document titled "Phase 1 Formula Grant Guidance." This document presents the amount of money allocated to each state, which depends in part on the number of orphan wells it has. For states with many orphan wells, they will be able to apply annually through 2028 for another portion of their budget. Over the course of the six years, Texas and Pennsylvania are eligible for the highest amount of funding, both of which are eligible for over $300 million each.

This money, however, comes with many strings attached. To receive this formula grant money, states must adhere to strict budget and reporting requirements, one of which is related to measuring methane emissions. Specifically, states must screen for and quantify methane emissions at each wellhead prior to plugging the well, following the procedures outlined in a 32-page document subtitled "Methane Measurement Guidelines.” This document describes a well screening process, the main leak rate quantification protocol, exact reporting requirements, and quantification methodologies and technology. Additionally, this document requires that all methane monitoring services must be conducted by a qualified measurement specialist (QMS), that has demonstrated 20+ hours of training and experience with the equipment needed to conduct the measurements.

During the second half of 2023, states were scrambling to come up with plans to fulfil the requirements of the grant guidance document, including the requirement to measure methane emissions. Since this is a very new and unique requirement, states came up with unique solutions to fulfilling this methane measuring requirement. Examples include:

- Subcontracting methane measurement services through the states bidding platform.

- Partnering with a university or state geological survey to conduct methane measuring.

- Conducting the methane measuring using in-house staff at the state regulatory agency.

- Requiring that the company performing the P&A work using IIJA money have plans to quantify methane emissions.

- Working through a statewide master subcontractor to further subcontract methane measurement services

On January 12, 2024, the DOI announced that Texas was the first to receive its formula grant money, which equals close to $80 million. Texas indicated that it would fulfil its methane measuring requirements using its own staff at the Texas Railroad Commission. The equipment they chose to utilize is an FLIR Optical Gas Imaging camera, which has the capability of estimating leak rates.

As more states receive formula grant money, we will see an increased demand for methane monitoring services. The exact technologies and procedures for executing this work are yet to be determined as more states receive their 2024 grant money.

2 – USEPA Inflation Reduction Act

Another federal program involving methane emissions monitoring comes from the United States Environmental Protection Agency (USEPA). In December 2023, funding from the Inflation Reduction Act was announced to be given to 14 states which are receiving a total of $350 million. This funding is to “support industry efforts to cut methane emissions from wells on nonfederal lands and support environmental restoration of well sites,” according to the EPA press release. Specifically, these states are to use this funding to provide “technical and financial assistance to help well owners and operators voluntarily identify and eliminate methane emissions from low-producing conventional oil and gas wells… with disproportionately high methane emissions.” Unlike the IIJA funds, these funds are to help well owners and operators study their active, producing wells, whereas the IIJA funding is designated only for orphan wells.

The largest recipient of this money was the Texas Commission on Environmental Quality (TCEQ), which received over $134 million. Currently, TCEQ is in a planning and development phase, but expects to begin executing the methane monitoring field work in the Fall of 2024. Whether that work is to be conducted by the operating companies, government staff, or 3rd party consultants is yet to be determined, but we know that demand for experts in this space will increase.

3 – USEPA “Quad O” and the Final Rule

Increasing regulation from the USEPA also drives increased wellhead methane emissions monitoring. In the Code of Federal Regulations, Title 40 (Protection of Environment), Chapter 1 (Environmental Protection Agency), Subchapter C (Air Programs), Part 60 (Standards of Performance for New Stationary Sources), we find Subpart OOOO, commonly known as “Quad O.” Quad O was established in 2012 as part of the New Source Performance Standards to implement substantial new methane emissions monitoring and reduction requirements for oil and natural gas sources. These requirements apply to facilities constructed or modified after August 23, 2011 and before September 18, 2015. Subpart OOOOa introduced a stricter set of requirements for facilities that were constructed or modified after September 18, 2015.

In December 2023, the USEPA issued its Final Rule which is aimed at sharply reducing methane and other harmful pollution. This includes implementation plans for Subpart OOOOb and OOOOc. Quad Ob applies to facilities constructed or modified after December 6, 2022. One major change from Quad O and Quad Oa to Quad Ob is the requirement to regularly monitor individual wellhead sites, which were previously exempt. Specifically, these obligations are for “all well sites to routinely monitor for fugitive emissions and repair leaks found—ranging from a quarterly audio, visual, and olfactory (AVO) inspection for single wellhead-only sites to quarterly optical gas imaging (OGI) inspections for any site with significant production equipment.” Should leaks be identified during these inspections, they must be repaired within 15 days.

Quad Oc is the guidelines governing future state rulemakings to regulate existing sources. States must implement their rulings within 4.5 years after the EPA Final Rule publication date. These state rules will apply to existing oil and gas operations and will constitute compliance with Quad O and Quad Oa.

Each of these Federal Programs demonstrates the need for increased methane monitoring services at wellheads. IIJA funding, USEPA funding, and the USEPA Final Rule establish the specific requirements and expectations to either receive grant money or to avoid compliance issues. As these programs begin to be implemented, we will undoubtedly see an increase in both technology offerings AND service companies/environmental consultants. These technologies and people will be prepared to meet the regulatory requirements by quantifying methane emissions rates from wellheads and surrounding production equipment.

Guardian Plug & Abandonment is a QMS-certified service provider offering methane emissions monitoring services. Please Reach out with questions at info@plugandabandonment.com or visit our website at https://www.plugandabandonment.com/.